I have met many renters over the years and many have been renters for years! I think some renters get comfortable and stop thinking of buying a home. Big mistake! The major issues with long term renting is you are paying someone else’s mortgage, meaning they own the home but you are paying for it. Here is a real eye opener, lets say your rent is $1300.00 a month which is pretty standard for a three bedroom two bath home in our market and lets say you are renting now for five years you have spent $78,000.00 just to put a roof over your head. That $78,000.00 building your landlords equity, and not one penny has built up your equity. Another issue is you are not building any wealth from real estate. It has been studied and almost 90% of Americans will use their home as part of their retirement. Hard to do when you don’t own a home or have not owned a home for a good part of your adult money making years.

Why is it that renters feel that renting is a better option? Often I hear that they do not want to have to cover the expense of things that break, like water heater, A/C unit, appliances, and other items that can be a little pricey to replace or repair. There is an easy affordable answer to this concern, a Home Warranty company. Home warranty companies have come a long way and many repair or replace the items that break as long as it’s in your home warranty coverage. So, you want to make sure when you sign up for a home warranty plan, it covers the items you want to warranty, the big ticket items. Home warranty plans start around $350.00 for basic plans, pick the one with the correct coverage it’s worth the annually cost.

The best way to approach renting is look at the length of time you plan to stay in a city or area. If it is longer then two years I would highly recommend looking at purchasing instead of renting. Renting should be a short term plan, short term plans would include when you’re not sure if you plan to stay in a city, your job or career is not for certain, relationship is still not fully committed, waiting on another property to be ready, or you get a job transfer and not sure if you will be staying at that location. The reason we use the two year mark is two fold, first you can sell after two years and avoid paying any capital gains tax and second is that most of the time real estate will appreciate in that time and the chances of you making a little or good amount of profit are good and worth the risk. If the market does not appreciate enough you could turn the house into an investment, rent it out for the time till it does appreciate possibly making a positive monthly income after expenses. Worst case you break even but remember someone is paying your mortgage during this time. If you do plan to rent it out I strongly recommend that you hire a property management company to manage the property and tenants. A property management company will handle the screening of tenants, collecting money, handling repairs, or handling evictions. They will charge eight to ten percent of the monthly rental income but it is worth the investment.

Here is the top five reasons renters get tired of renting

- They can not make the changes they want to the property because they don’t own it.

- Landlords don`t fix the problems with the property.

- Things in the house are not upgraded, old flooring, old appliances, dated cabinets, or unappealing landscaping.

- The house does not have everything you need like space, extra rooms, pool, garage, or patio.

- They don’t allow pets and you want to get a dog or cat to add to your family.

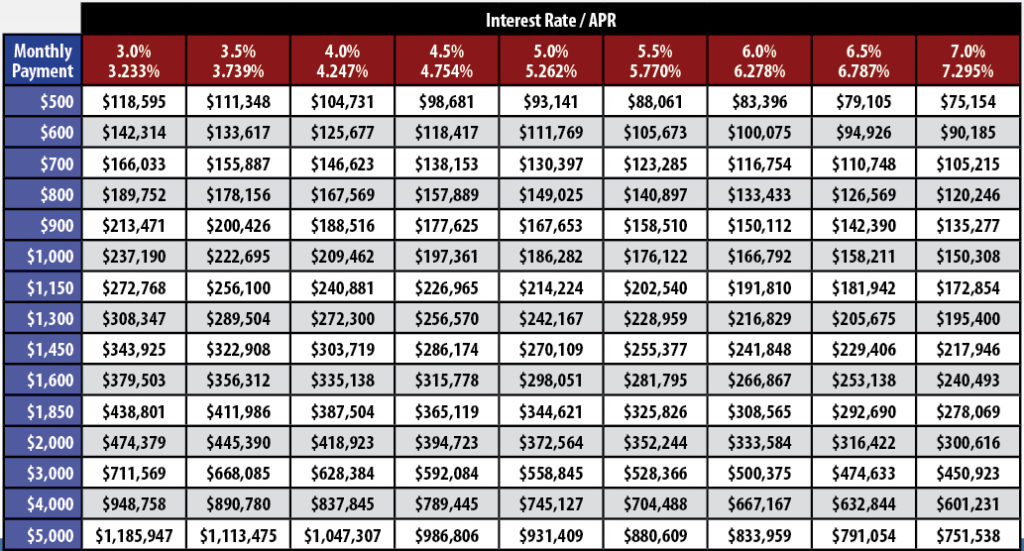

Here are some compelling reasons to buy a home: interest rates are at historic low and there are down payment assistance programs that will help you with your down payment. The strongest reason to buy when the interest rates are low is that you as the buyer will qualify for more money allowing you to buy a better or bigger home. Check out the mortgage interest rate chart, pick the monthly payment you feel most comfortable with then see when the interest rate rises and you qualify for less, as it goes up you lose buying power.

Top 10 benefits of owning your home

- It is yours! All the design and improvements are for your benefit and increase your home value, it`s not wasted money.

- Lifestyle- your home is an expression of you and your lifestyle.

- Freedom from rent increases.

- Building equity for your future, money for a move up purchase or full your retirement.

- Keeping up with inflation, Since you are paying it off over time you are using “cheaper dollars” due to inflation to pay off the mortgage.

- Stability- you will not have to move because your landlord wants to sell.

- Security for retirement- 90% of Americans will use their home as part of their retirement plan.

- Income tax benefits.

- Trade up value- if your home value increases over time and you paying the mortgage down allows you options for further real estate moves. Maybe you buy an investment property or a bigger home, you have options.

- There is no place like home!